We could fill an entire book explaining why you should use tax software instead of doing everything manually or with the help of a certified tax expert, but if you really need to know why then here are just some of the most important reasons:

Convenience

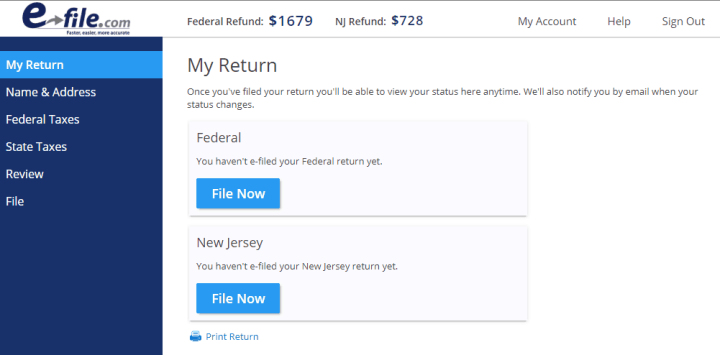

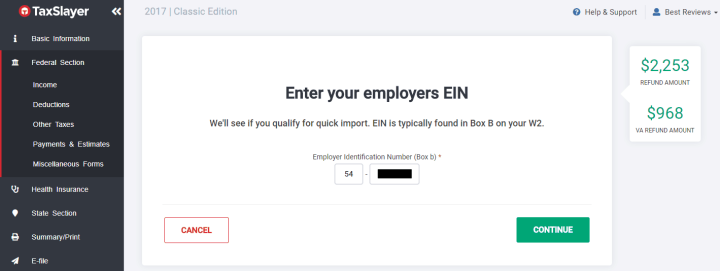

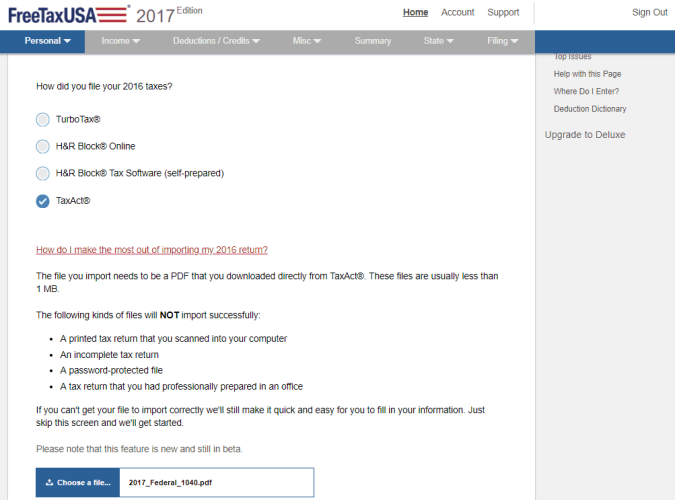

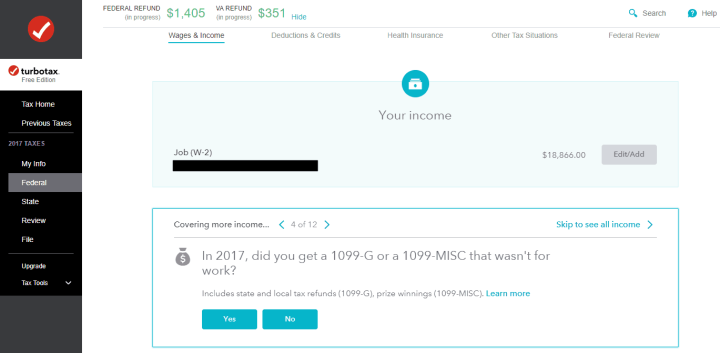

While a desktop tax prep program is a huge asset, it’s actually online tax software that is the best solution primarily for its ability to prepare taxes as conveniently as possible. For starters, all taxpayers need is a browser to start putting together their returns, but thanks to the software’s cloud-based nature there is also the option to continue filling out the same forms on the go using the program’s mobile browser or bespoke app versions. In addition to that, online tax solutions reduce manual data entry to a minimum as not only can they automatically collect the required forms for you based on the answers given during the interview process, but they are also capable of importing various documents like W-2s and the details from the last year’s return.

Simplicity

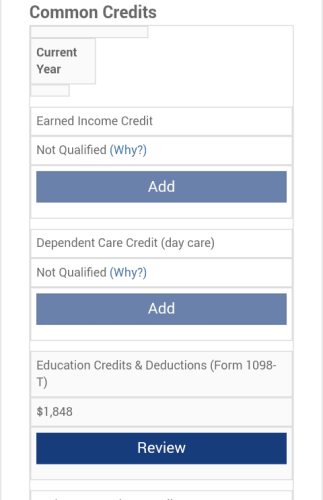

There are many different iterations of tax software but if there is one aspect that they all share it is the fact that they all conduct thorough interviews to better understand the needs of the user and then to guide them to and through the forms that they need to file. This alone means that the tax process becomes ridiculously simple with the use of such software, making them the perfect pick for first-time filers as well as for those who want to prepare their returns on their own but aren’t that familiar with current tax laws.

Versatility

One of the best things about tax programs is that they are capable of satisfying the needs of any taxpayer, so that no matter how complex your tax situation is you’ll be sure to find a suitable version of the chosen tax software. In fact, aside from the programs that are mostly intended for individuals, there are even special products that cater towards businesses, too.

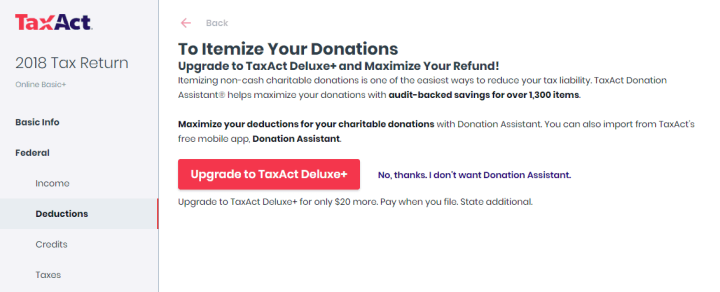

In addition to that, there is no need to worry even if the wrong online product is chosen, since the program constantly monitors the answers of the user and if the current version doesn’t contain a form that the user needs it will automatically prompt to upgrade to a higher-tier version that includes the necessary document – which can be performed manually as well.

Costs

By far the biggest reason to use tax programs is their prices. Whereas certified tax experts can provide their tax prep services for hundreds of dollars, tax software is much cheaper – even if the top-tier version is chosen. Sometimes tax companies even provide a free version of their programs with which taxpayers that only need to file simple tax returns can do so in a fast and convenient manner. Online tax prep programs can typically be used entirely free of charge until the returns are filed and in fact the service can be paid for by deducting the final bill from the taxpayer’s claimed refunds.

Live and Additional Support

It doesn’t matter how convenient tax software is if users cannot move forward with filling out their returns when becoming stuck with a question they don’t understand. Tax program providers know that, which is why they also offer live assistance conducted by certified tax experts to any user that opts for higher-tier products. Additionally, taxpayers also have the option to purchase additional support in the form of services like IRS audit assistance or ID theft protection with which they can make sure that they’ll be protected by the company should anything unexpected occur.

It doesn’t matter how convenient tax software is if users cannot move forward with filling out their returns when becoming stuck with a question they don’t understand. Tax program providers know that, which is why they also offer live assistance conducted by certified tax experts to any user that opts for higher-tier products. Additionally, taxpayers also have the option to purchase additional support in the form of services like IRS audit assistance or ID theft protection with which they can make sure that they’ll be protected by the company should anything unexpected occur.

Best Tax Software of 2024

| Rank | Company | Info | Visit |

|

1

|

|

|

|

|

2

|

|

|

|

|

3

|

|

|

More FAQs

- Why Should I Use Tax Software?

- Which Tax Software Should I Use?

- Should I Update My Tax Software?

- Is Tax Software Deductible?

- How Does Tax Software Work?

Get the Best Deals on Tax Software

Our monthly newsletter delivers the latest tax software deals, trends and reviews directly into your inbox.