Although the IRS doesn’t specify exactly how tax returns should be prepared, filling out the necessary forms with the aid of a dedicated tax preparation program is definitely easier than doing the whole process manually. In fact, those who aren’t afraid of dealing with their taxes on their own and therefore don’t require the services of a certified tax expert, such software is without a doubt the best solution. Tax programs are simplified to such extent that even the least tax- and tech-savvy people will understand them and be able to create fully IRS-compatible returns with relative ease.

Although the IRS doesn’t specify exactly how tax returns should be prepared, filling out the necessary forms with the aid of a dedicated tax preparation program is definitely easier than doing the whole process manually. In fact, those who aren’t afraid of dealing with their taxes on their own and therefore don’t require the services of a certified tax expert, such software is without a doubt the best solution. Tax programs are simplified to such extent that even the least tax- and tech-savvy people will understand them and be able to create fully IRS-compatible returns with relative ease.

Tax Preparation Through Questions

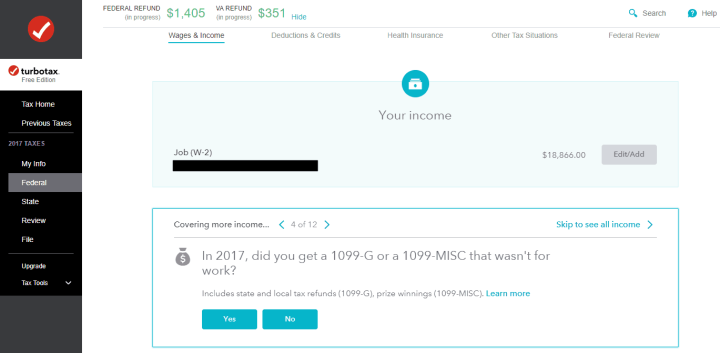

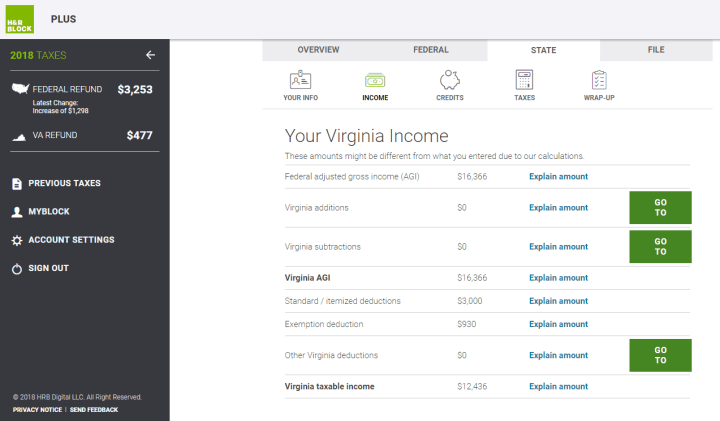

To be honest, tax software does exactly the same thing that a certified tax expert would as it also conducts thorough interviews to get to know users better, allowing it to then offer the right service based on the answers. The biggest difference between personal assistance and tax programs is that by opting for the latter users will not only conduct the interview for themselves but they don’t have to leave the comfort of their homes to do so. There is absolutely no need to figure out a single sum, either, since every calculation is done by the software itself, therefore reducing the possibility of an erroneous return.

You don’t even have to know exactly which forms have to be filed as part of your return because the software automatically selects the necessary forms based on the answers provided during the interviews, meaning that you won’t waste any time by looking up the documents you’ll need for filing. Simply put, the only things needed to start tax preparation with tax software are the return from last year and any documents related to the relevant year’s income and deductions.

Automation via Data Importing

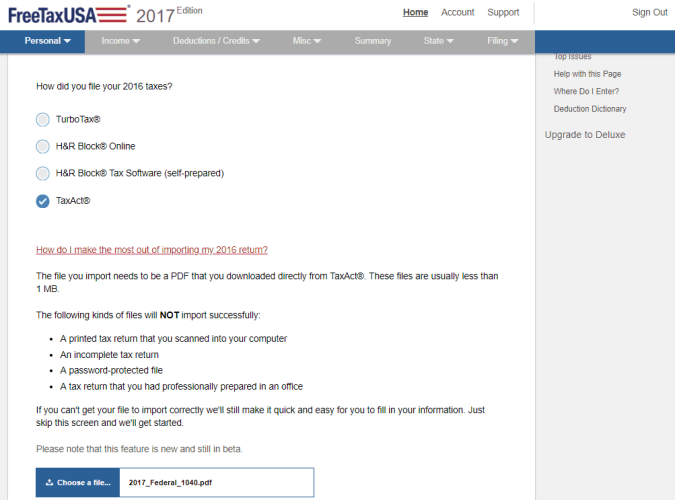

The fact that the tax return is prepared by simply answering questions is a huge asset, but tax software still ups the ante by providing data importing, too. For instance, such a program can fill out almost the entire return with little to no human interference, though usually this is only the case if you prepared your previous year’s return with the same solution. However, these programs are often also capable of pulling data from returns created through other means as well as from electronic W-2s. And when it comes to W-2s, many tax companies provide mobile applications, which comes the added bonus of being able to snap a photo of your W-2 which will allow the program to fill out the digital version of the same document in no time.

E-Filing at Your Service

The good news is that regardless of which online tax solution is chosen, you’ll be able to e-file your returns without hassle – unless it’s a return related to a previous year, in which case the only option is to file via snail mail. However, one thing that’s certain is that filing federal tax returns is always free of charge no matter which version of a program is chosen and whether extra services like IRS audit assistance or ID theft protection have been purchased.

No Out-of-Pocket Expenses

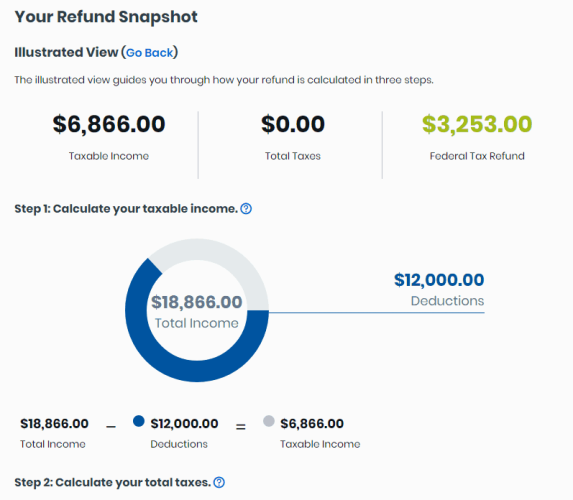

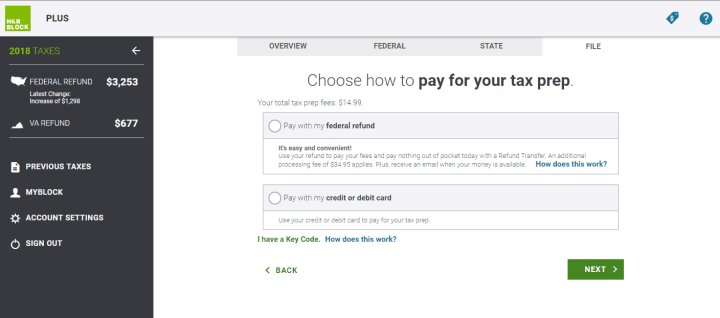

A huge advantage of tax programs is that they allow users to pay the service provider by simply deducting the cost from their earned refunds. Although this payment method costs extra – usually between $25 and $40 – settling the invoice this way is not only highly convenient but is barely noticeable if you’re claiming back thousands of dollars in federal and state refunds. And if you think about it, deducting service fees from the refund amount essentially makes using the software free of charge.

Easy Tracking of the Return’s Status

With tax software on board there is no need to worry about whether the IRS has accepted the return or not, in fact the program will not only inform you about the status of your return on its homepage but it will also send out automated email messages whenever anything noteworthy happens. While refund status isn’t tracked by the software – this has to be done on the dedicated page of the IRS – at least knowing that everything is all right with the returns is a huge relief for any taxpayer.

Best Tax Software of 2024

| Rank | Company | Info | Visit |

|

1

|

|

|

|

|

2

|

|

|

|

|

3

|

|

|

More FAQs

- Why Should I Use Tax Software?

- Which Tax Software Should I Use?

- Should I Update My Tax Software?

- Is Tax Software Deductible?

- How Does Tax Software Work?

Get the Best Deals on Tax Software

Our monthly newsletter delivers the latest tax software deals, trends and reviews directly into your inbox.