Visit E-fileOnly $19/State Refund

Free Versions Coupons

Visit E-fileOnly $19/State Refund

Free Versions Coupons

| Editor's Rating | |

|---|---|

| Overall | |

| Features | |

| Price | |

| Customer Service | |

Positives

- Unlimited use until payment

- Straightforward form filling process

- Mobile-friendly, straightforward account

- Good default and extra security options

- Cost-friendly base prices

Negatives

- Lack of form importing

- No live audit before filing

- Lack of organized support

If there’s only one thing that frustrates the most with tax preparation software, then perhaps it has to be the prices. The technology is certainly getting better and better with each passing year – especially since the introduction of cloud technology – but the base prices still make the eyes of millions roll in frustration. It’s not even like the free tax programs are worth using because once this method has been chosen, upgrading to a better package to prepare different forms can be quite the challenge. E-file, a company founded in 2013, is nothing like that. While it is a basic service devoid of many of the fancy extras that its competition provides, it’s definitely capable of doing exactly what it is supposed to do: creating tax return forms and filing them via a secure, user-friendly account. This doesn’t sound all that compelling at first, but add in the company’s aces in the deck – namely the unlimited nature of the program and its unbeatable prices – then E-file is indeed a service that’s worthy of your attention.

Features

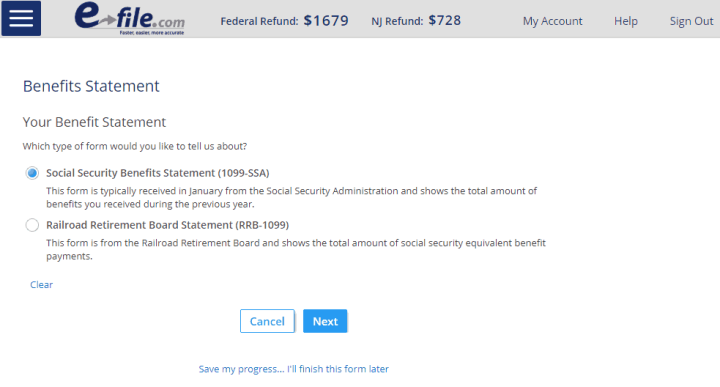

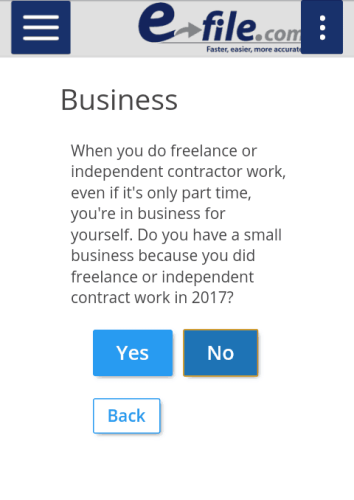

As with all tax preparation software, the key word at E-file is simplicity. For this reason, the program promptly guides you through every single step as soon as an account is created, even paying attention to such details as whether it’s two people filing a single form or the filer is acting on behalf of a deceased taxpayer.

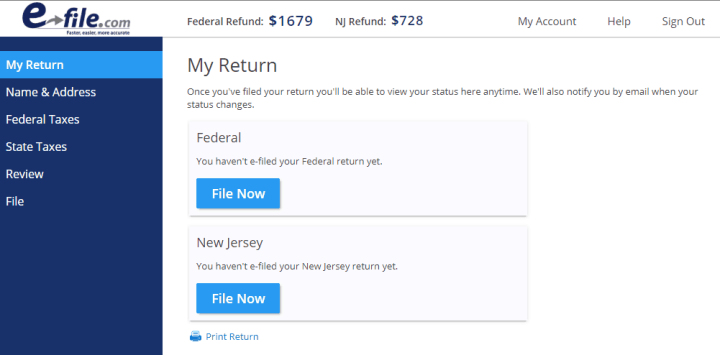

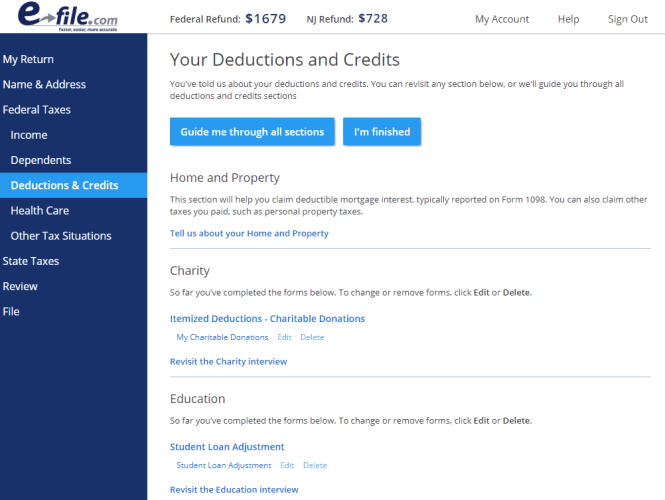

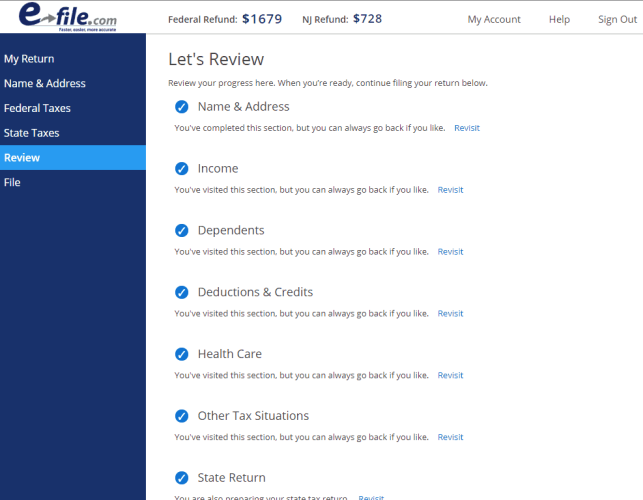

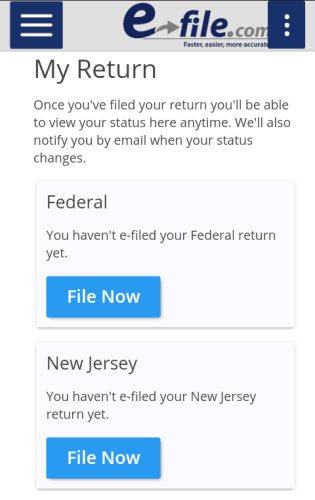

Thankfully there is no need to fill everything out in one sitting as the progress can be saved at any time and continued later on, even though the software won’t tell you exactly where the process was interrupted before signing out. However, finding the form where you left off is rather easy and not just because there is an option to search for specific forms under the “Reviews” section. The software conveniently separates federal tax and state tax returns, and in the case of the former the necessary documents are organized into easily understandable categories. And if that’s not enough, after filing is completed, E-file tracks the status of the return and will even send out an email should anything noteworthy occur.

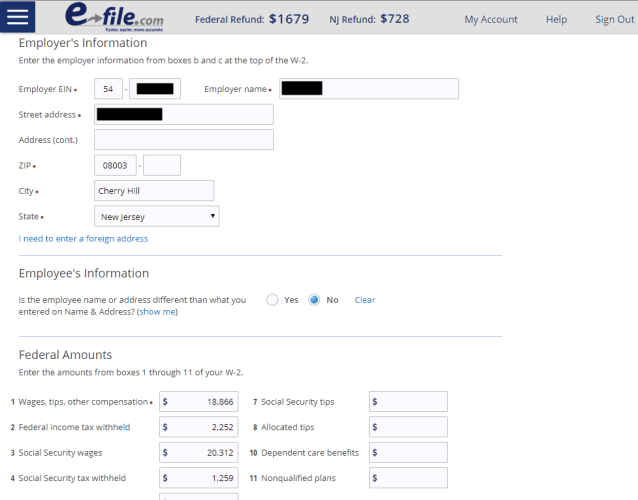

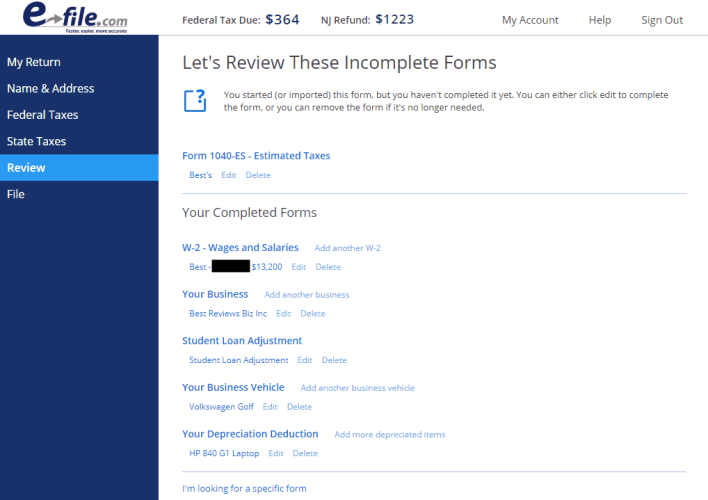

Sadly, even if the program does its job of preparing the tax return form for e-filing to the IRS perfectly, the service itself isn’t perfect. One of the biggest problems is that throughout the process there is no way to request the help of an auditor in real time – unless taking customer support into consideration, which we’ll talk about later. Still, the most noticeable defect of E-file is that it completely lacks an autoprocessing feature, meaning that importing tax return forms created by a competing service or any other means is simply out of question. Granted, the program is capable of pulling information from other forms that have been provided during any of the previous steps but, to be honest, this barely helps users get their returns ready for the end of tax season any faster.

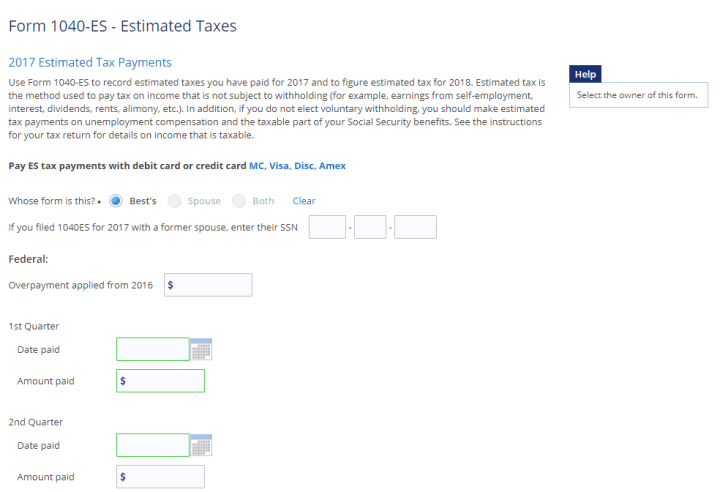

Taxes

The lack of autofilling can be a huge pain in the neck but getting tax forms ready isn’t complicated at all. This is mostly due to the fact that everything is explained in plain English; in the vast majority of cases there is no need to know the exact name of a form since the program not only displays and explains them properly but it also automatically adds the necessary documents to the tax return based on the answers given during the interview process with the user. As such, it’s safe to say that no matter what kind of form is needed, E-file can handle it without hassle.

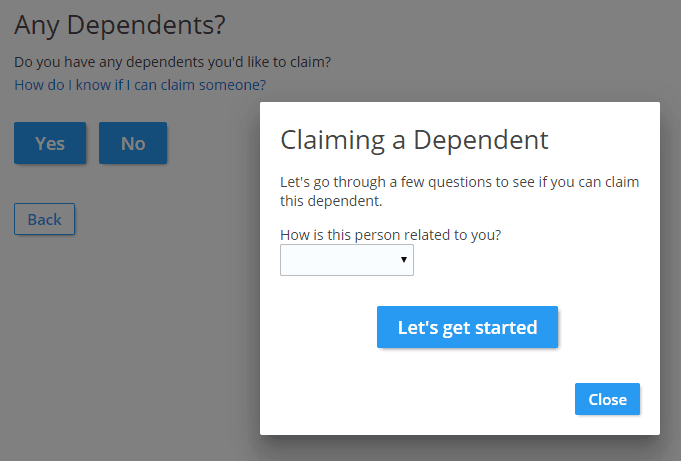

As for the forms themselves, most are for federal tax returns and can be found under their respective categories like incomes, dependents, credits, deductions, health care, and miscellaneous taxes. Simply put, no matter what your tax situation is, forms like the W-2, all 1099s, the 1040 and many more are ready to be added to the final tax return form.

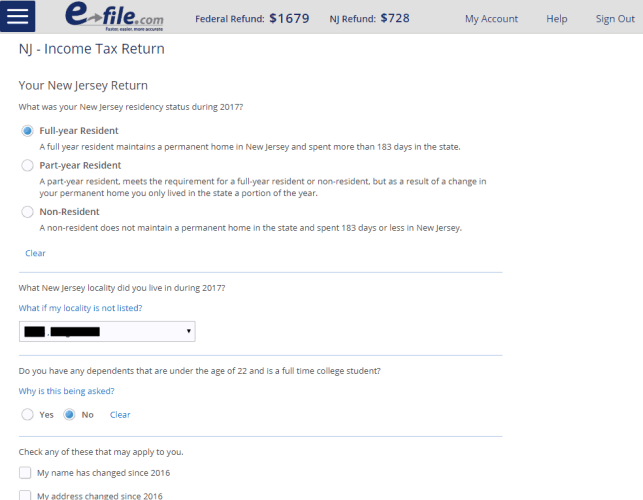

Filling out state tax is just as easy as their federal counterparts, although it’s worth noting that the program will ask fewer questions that, thankfully, won’t make these forms any less detailed than federal tax documents. In addition to that – and as is the case with virtually all tax prep software – there is no obligation to file state tax returns with this program, though you should remember that if you do then filing such forms with E-file will always cost extra.

Filing and Extras

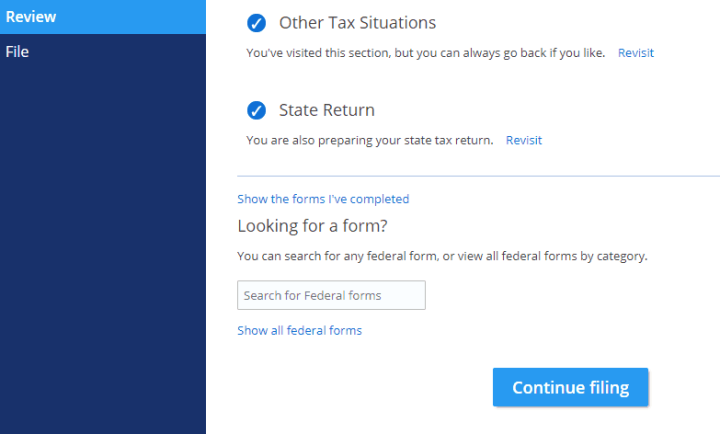

Thankfully, the review and filing process is ridiculously simple and – like when preparing forms – is guided by the software’s built-in assistant. The program checks everything before moving on to filing, even paying attention to such details as whether there are forms that still need to be completed or if the provided SSN number is valid. This is also the last moment to revoke the option to file state tax returns with the service and to decide whether the completed returns should be e-filed or not.

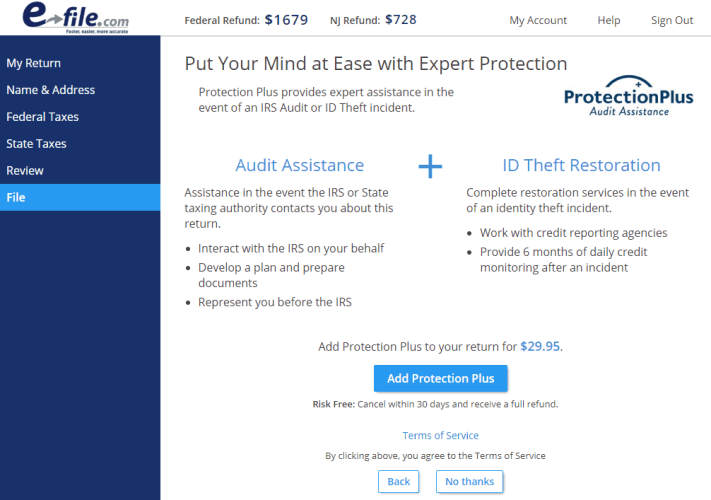

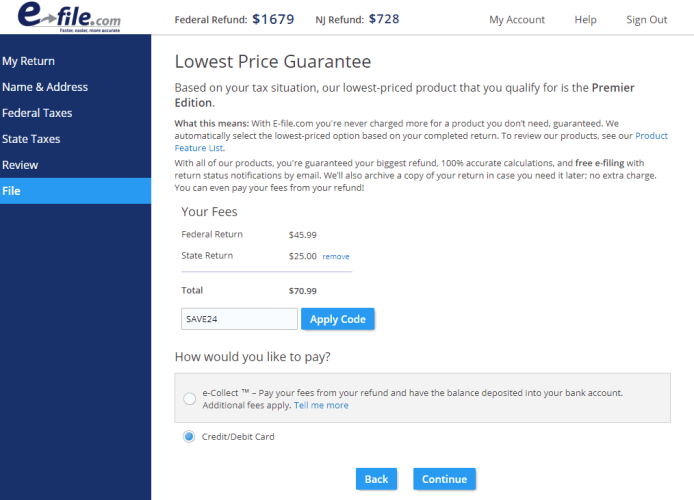

It’s also at this point where users can purchase the Protection Plus package for $29.95 – which contains audit assistance and protection against ID theft – and decide whether E-file should be paid by credit or debit card or instead by deducting the service fee from the calculated tax refund. In case of the latter, however, note that the final amount of the refund will be less because the company will keep $24.95 as part of its e-Collect service. Only after payment has been made can you view the tax refund form for the last time before e-filing or printing and mailing it to the IRS.

Mobile & Software

Since E-file.com concentrates on providing its services as cheaply as possible, it’s no surprise that there are neither downloadable programs nor mobile applications through which taxpayers can fill out their forms. However, due to the fact everything is stored in the cloud, accounts can easily be accessed from any device sporting a browser. In fact, much to our surprise, not only does the tax prep solution perfectly adapt to any mobile screen but it also allows users to perform everything that they could if they were sitting in front of the computer. However, since this is a mobile version of the software it suffers when compared to other tax preparation tools that feature smartphone apps due to the lack of the W-2 capturing feature.

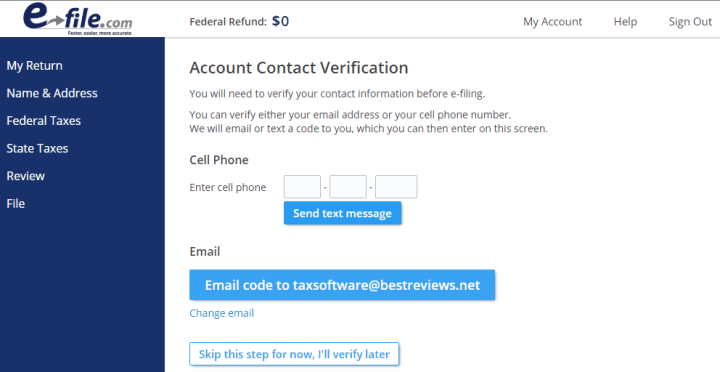

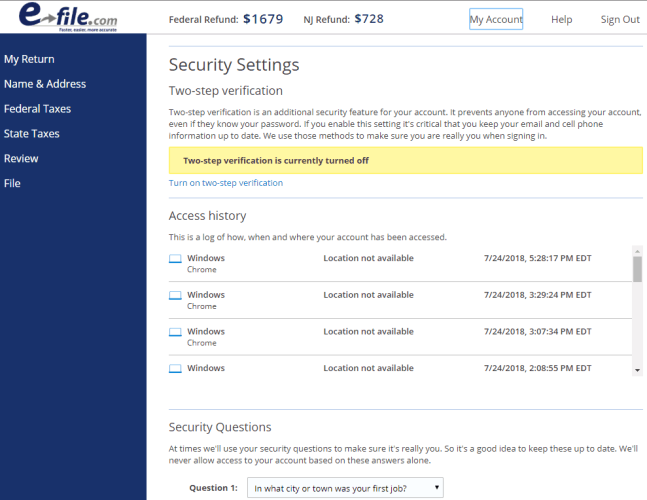

Security

E-file takes itself rather seriously when it comes to safeguarding taxpayers’ information. For starters, every time you access the account from another device for the first time you will need to provide a temporary passcode that is sent via SMS or email. Although this process is only mandatory with each new device, there is still the option to activate two-factor authentication, providing an additional layer of security.

But E-file doesn’t stop there, quite the contrary. For example, the software logs account activity and will send automated emails should any of the most important data be modified. This is especially true for the Social Security number as the program will always alert users of a fake or duplicate SSN before filing and it will even prevent this data from being changed after a few modification attempts have been made. But probably the most important aspect to E-file.com’s security is that it never requires the sharing of any data with third parties to enjoy a more streamlined tax preparation experience.

Pricing

E-file.com might well be a limited tax prep service but when it comes to value for money it’s virtually unbeatable. For starters, every user is entitled to enjoy the software itself for free and without any limitations. While this means users might not know how much they need to pay until the end, the prices are well below that of the competition. Aside from the free federal tax return package – available to those filing a single 1040EZ form – there is Deluxe Plus for $24.99 and the full Premium Plus package for $45.99. These prices, however, can be further reduced with temporary discounts, which also applies to state tax return filings and their default price of $25 per state.

It’s worth adding, though, that Protection Plus is an exception to this rule, and as such its price stays at $29.95 at all times. However, this extra service comes with a money-back guarantee, which entitles you to a full refund should you cancel it within the first 30 days of use.

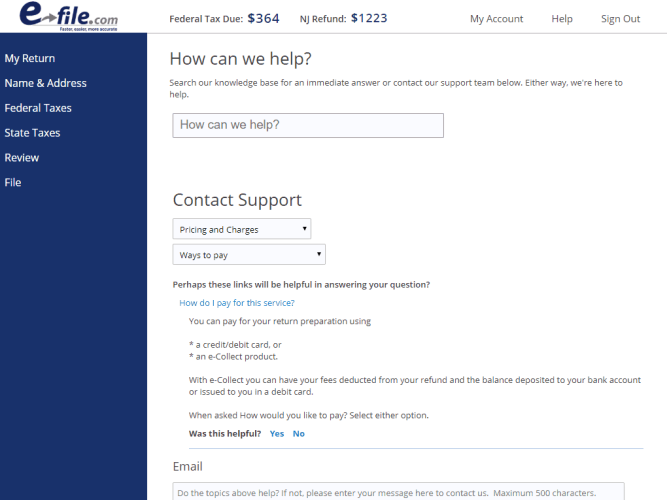

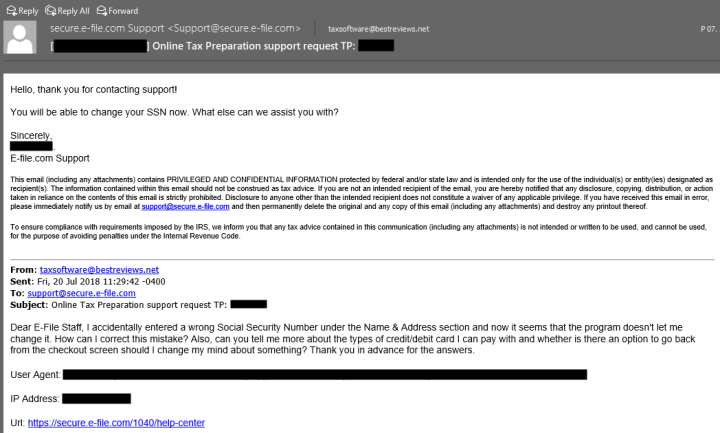

Customer Support

E-file’s customer support is a bit of a hit and miss. Don’t get us wrong, it perfectly does its job especially where direct support is concerned; when we encountered a problem regarding the Social Security number, it took less than half an hour for the staff to answer our inquiry and solve the issue – a speed that would be well-appreciated in any other industry.

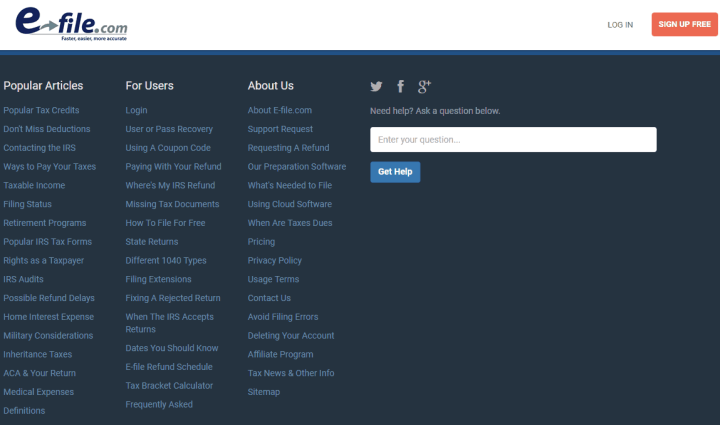

But no matter how fast and courteous the staff is, it’s hard to overlook the various issues that make E-file’s customer support mediocre. The first reason is obvious: the lack of popular support options like phone and live chat – unless we take into consideration the site’s social media pages. The second reason is more of an annoyance than a major problem: even if E-file does maintain its own FAQ, it’s not worth much since the most important questions are all answered in bigger, blog-style articles that are scattered at the bottom of the main page.

Bottom Line

It’s pretty obvious from the get-go that E-file is a pretty basic service that provides only the most necessary features associated with tax prep programs. However, in its own category, it is undoubtedly the best option to go for. Admittedly, the lack of data import – the most noticeable missing aspect of the program – would typically suggest a mediocre product but, thankfully, E-file is far from that.

It’s pretty obvious from the get-go that E-file is a pretty basic service that provides only the most necessary features associated with tax prep programs. However, in its own category, it is undoubtedly the best option to go for. Admittedly, the lack of data import – the most noticeable missing aspect of the program – would typically suggest a mediocre product but, thankfully, E-file is far from that.

Features like the logical categorization of tax forms and the built-in virtual assistant that explains everything in an understandable manner makes the tax preparation process truly hassle free. Details like the advanced security of accounts or the option to use the software without restrictions just make E-file even more of a bargain than it already is, especially true thanks to the service’s unbeatable prices. It’s safe to say that filing tax return forms with E-file is indeed worth the investment.

Visit E-fileOnly $19 per State RefundBest Tax Software of 2024

| Rank | Company | Info | Visit |

|

1

|

|

|

|

|

2

|

|

|

|

|

3

|

|

|

Share Your Review